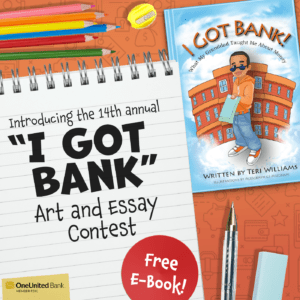

Americans need to save more. In a Bankrate.com survey conducted last June, a quarter of those who responded said that they did not have emergency savings of any kind. 67% of those who did have savings said that they had less than the 6-month recommended fund. There is a wide variety of reasons for this, but in most cases, there is room for improvement. Even if you have never saved before, now is the perfect time to start. Let’s take a look at several strategies to help you get on the right path to greater savings.

Take a look at your budget: Before you start considering savings plans, the first thing you need to do is take control of your finances. This means making a budget and recording all of your expenses to see what your needs are and how that correlates with your spending habits. For example, if you’re eating out once or twice a week for lunch, that can add up quickly over the course of an entire month. By reviewing your budget and expenses, you might be able find ways to make some cuts to live better within your means.

Pay Down Your Debt: Debt with interest can quickly hinder your ability to save. It’s for this reason that it’s recommended to take care of your higher interest debt first. For example, if you have a balance on a credit card with a 20% APR, it would be prudent to pay that off before saving where the interest rate you’ll earn will be far less.

Consider Short-Term and Long-Term Savings Options: The first rule of saving is to let your money work for you. Therefore, leaving it in your checking account will not do you any good. In fact, it could make it more tempting to spend it. Instead, you should consider short and long term savings options with your bank.

Several short-term savings options include:

- Regular Savings Account

- High-Yield Savings Account

- Money Market Savings Account

- Certificate of Deposit (CD)

Long-term savings options include IRAs and securities.

Work on Improving Your Credit: A poor credit score will yield either no credit opportunities or those with higher interest rates. If you can, pay more than the minimum each month and avoid paying late. If you don’t have any credit, there are credit cards for bad credit available. For example, the UNITY Visa we offer is a secured credit card that allows members to build their credit when they wouldn’t normally qualify for credit.

For more information on how you can start saving today, please visit https://www.oneunited.com.