Cash vs. Credit: How to Be Savvy About Your Spending

Being money savvy isn’t just about how much you make versus how much you save. It’s also about how you manage that money. What does

IMPORTANT NOTICE: OneUnited Bank is providing these links to websites as a customer service. OneUnited Bank is not responsible for the content available at these third party sites. The Bank's privacy policy does not apply to linked websites. Please consult the privacy disclosures on each third party website for further information.

Spend 5 min, Start Building Wealth

Accounts

For Businesses

Your Financial Future, Your Choice

Financial Wellness & Freedom

Being money savvy isn’t just about how much you make versus how much you save. It’s also about how you manage that money. What does

Companies are aggressive when it comes to marketing to teens celebrating their 18th birthday or heading off to college. Is your kid ready to tackle

Prepaid credit cards have grown in popularity over the last several years, with Americans spending more than $200 billion on them in 2014. Many consumers

Did you know that a low credit score can cost you more than $5,000 in finance charges on a five-year car loan? That number may

Misconceptions often arise when it comes to credit scores and credit access, especially as they relate to public records. As an example, public records may

Have you ever written a check or used a debit card and ended up with a bounced check fee? While bouncing a check can be

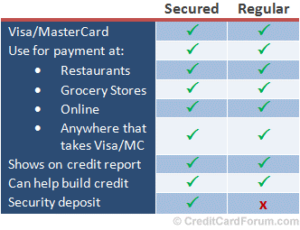

When establishing or rebuilding credit, many are confused by the differences between secured and traditional credit cards. Even if you know the basic distinction between

Elevate your finances with insights, because we all need answers. Sign up today!

See exactly where you’re spending money, how you’re achieving and how you can improve.

Accounts

Essentials

Elevate Finances

For Businesses