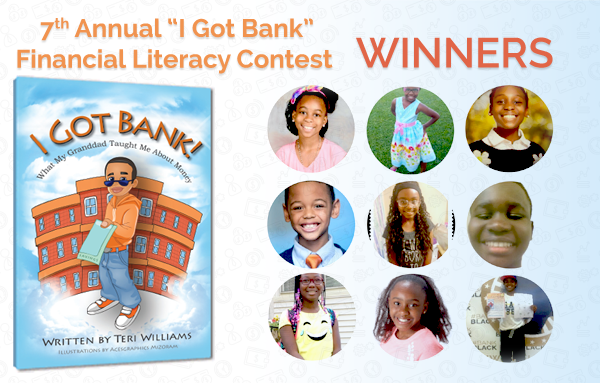

Congratulations to our 2017 “I Got Bank” Financial Literacy Contest Winners: Sulaiman Barrow, 12, Michigan, Christian Chandler, 9, New York, Stacy Gonzalez, 12, California, Kirshauna Harvey, 12, Mississippi, Riley Johnson, 8, California, Kennedi Moss, 10, Ohio, Tahira Muhammad, 12, Massachusetts, Camarria Saunders, 11, Florida, Sharday Sypher, 10, Florida and Corday Yoakum, 8, California.

Here are their essays and art!

SULAIMAN M. BARROW, 12, MICHIGAN

Sulaimon’s Essay

The finance book I read: “Financial Fitness For Teen: 6 Steps From Broke To Abundance”, by Chris Brady. This book is LIFE Leadership Essentials Series published October, 2014.

The book has 6 main chapters excluding the Forward and the Introduction. It is a must read for any teen who wants to be financially literate and successful. Who doesn’t know Mr. Robert Kiyosaki -the author of Rich Dad Poor Dad and many, many successful financial books? He did the introduction to the whole book. Among other things he laid out why schools are not teaching financial education or literacy. He ended with the six steps teens will learn in the fantastic book. It is a one week read taking into consideration your school work. Wish every high school kid will read this book.

The chapter I wanted to discuss in the book is Chapter 3: or Step 3: SAVING MONEY. In the opening of the chapter is a quote by Henry H. Buckley. He said, “Save a part of your income and begin now, for the man with a surplus controls circumstances and the man without a surplus is controlled by circumstances”. I love this idea because if you want to be financially successful, no matter your age, color, education or background, you need to SAVE! SAVE! SAVE1 SAVE!

The book gave the following recommendations for every teen: 25% life savings, 25% emergency savings, 10% Tithing, 10% Charity or Giving 15% for big future purchases, and 15% fun or entertainment. For many teens like me we don’t have much expenses out of our allowances or whatever sources of income you may have. You don’t put food on the table, or pay any car note or rent in order words. Let’s strive for a higher saving percentage. My challenge to you is 50% to your savings account. With this strategy, any teen can be successful especially at their adult life.

It was also pointed out in the chapter the first principle of financial success is: It’s not what you make but what you keep determines financial abundance and success. In order words: PAY YOURSELF FIRST. My big sister and I have a Summer Water Selling Business since June, 2015, established and supervised by our Dad. Love you Daddy! We have followed this pay yourself first formula but at 50%. Last year, 2016 we made in our business $2500.00 and saved half -$1250.00 This year we want to do $3500.00 – $4000.00 and imagine if we can put way 50% or more in our savings. My Dad is the driving force behind our saving habit. This year he will teach us how to put some of our saving in the stock market or our favorable companies. The saving to invest your money wisely is emphasized in the Chapter. I would also like to mention a girl from Ohio whose story was highlighted as how when she understood the principles of saving became financially successful before leaving college. If she can do it, all teens can do it. Just like what Nike said JUST DO IT. All you have to do is to buy this book or maybe borrow it at your local library. Read it: Keep reading it and apply the principles.

To conclude, let’s recap this Chapter on savings: 1: Save! Save! Save! 2: Saving is a right financial habit and the earlier you establish it the better 3: Remember you should save to invest in the stock market. Leave your savings alone. Don’t spend it 4: Use percentages as suggested or take my challenge: save 50% of your income or allowance starting today. 5: Look at and study some of the most successful people like Warren Buffett one of my financial heroes and we can be like him or exceed him. I hope again every teen will read this book. There are many other good books on teen finance, but this book is outstanding. Bravo to Christ Brady and all the other authors in the book.

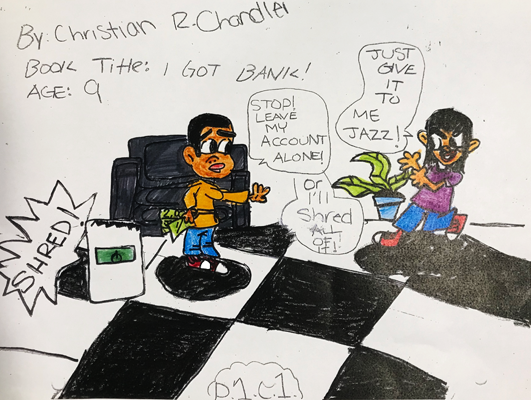

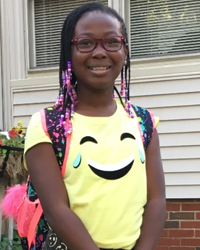

CHRISTIAN CHANDLER, 9, NEW YORK

Christian’s┬áArt

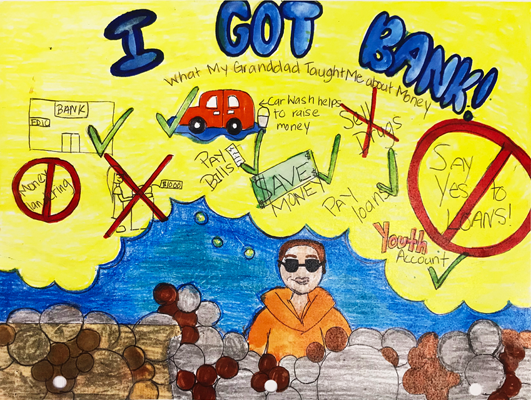

STACY GONZALEZ, 12, CALIFORNIA

Stacy’s┬áArt

KIRSHAUNA HARVEY, 12, MISSISSIPPI

Kirshauna’s Essay

My Future Can Be Bright With Saving

I Got Bank!: What My Granddad Taught Me About Money was such a super book that has inspired not only me but my brother as well to save even more towards our futures. Kids need to know the importance of saving especially in a time when our futures are so vague. We live in Mississippi where education, poverty and money are just some of the things wrong here.

In the book, Jazz Ellington was excited to have money and it made him feel important and responsible. I also feel that way when I get my allowance or make some money. Jazz’s grandad did a great job of teaching him how to save his money. It is my wish that all Black kids be able to read this book and learn the things I have learned from it. One reason I hope for that is because not every Black child has someone like Jazz’s granddad or like I have in my mom to inspire them to save and look toward the future.

Jazz and I are very similar in certain areas of our lives. While Jazz is ten years old in the book, I am eleven. Even at our ages it is super important for kids to know the value of saving and how to be wise with money. My mother always says, “If you cannot be responsible with the $20 I am giving you, then how will you be responsible with $200?” For the few times she said it, my brother and I were scratching our heads scratching in curiosity as to what she was talking about. Even at the age of eleven I know that it is very important to save and not spend all my money.

I Got Bank: What My Granddad Taught Me About Money taught me even more valuable information about saving. Money is not always easy to get as my mother always points out and I know that I should be grateful and cherish every bit of it. In closing, I would like to thank Mrs. Williams for writing this book and helping to teach Black kids like me what it means to save and be safe financially. My mother tries to teach me but as a former single mother for years, she still struggles from a divorce from our father and is trying to be where she needs to be financially.

With books such as this one, the determination of my mother, prayer and the God’s grace, I am sure to succeed in the future regardless of what is in my way. My future can be bright with saving! If the selection committee sees fit that I am deserving of this opportunity then I will use the savings account to start the college fund my mom and I want for me. Thank you in advance for your time and consideration.

RILEY JOHNSON, 8, CALIFORNIA

Riley’s Essay

From the book, “I Got Bank” by Teri Williams, I learned about saving, spending, earning and being financially aware. In this awesome book, I learned six key things like not giving people money without knowing how they will spend it, make a plan before you spend your money. Pay for your belongings especially your car or it will be repossessed. That means in the middle of the night they take your car. I also learned that you need to pay attention to how many wants and needs you have. It is important to buy more needs than wants. I also learned about the four P’s, which are product, price, promotion and place.

I created the four S’s. They are SAVE, SHARE, SELL, and SPEND. Sharing with the less fortunate is an important thing to do I will use this in my family by helping my family have a budget so we know how much we can spend. I will also help save for my college fund. I don’t have any money of my own yet but I was thinking my friends and I can give $20 dance classes. They will be $20 a week for the classes. Having a business in your community gives people jobs and services that they need. I can’t wait.

KENNEDI MOSS, 10, OHIO

Kennedi’s Essay

$Kennedi’s Got Bank$

I read the book “Danny Dollar Millionaire Extraordinaire” by Ty Allan Jackson and learned about banking words and what they mean. My name is Kennedi and I am 10 years old. Saving money is important because everyone should have money for college, retirement or if you lose your job.

As a role model for my little brother, I am an example of saving for the future. My parents helped us to open savings accounts to deposit our allowances and put some in an envelope at church for God, before buying ourselves a treat. This teaches me to be responsible with money, therefore I will be able to have good finances when I am an adult and teach my children about money too.

I am excited about planning my money for my future and teaching others also. My 6-year-old brother and I go to the bank every month to put money into our accounts. This is called depositing; when you put money into the bank. I receive $6 in allowance each week, and he gets $4. If I win $1,000, my brother will be sad, so I will split the money so that he will get $500 and I will get $500.

There are about 7 million millionaires in the world, and I hope that my brother and I will become ones too. I included a business card that I made about my cookie company that I hope to begin someday to help my family and others become wealthy.

Thank you.

TAHIRA MUHAMMAD, 12, MASSACHUSETTS

Tahira’s Essay

In the book “I GOT BANK” by Teri Williams, I learned many things. The book was very interesting and informative. I learned why its is important to save money, to invest in products or businesses. Lastely, I learned about the four P’s which is product, promotion, place and price.

”

A fool and its money will soon be parted. – Unknown

Recently I went on a field trip to Gillette Stadium and I recognized that all of my friends rushed to the store and bought the first thing they saw. Some of them bought Dunkin Donuts and others bought souvenirs like little keychains that cost way too much money.

Reading this book gave me a better understanding of why saving money is important so I can use it for when I really need it. For example in Chapter 16, Jackson wanted to look cool and buy this nice looking car which he couldn’t afford. Because Jackson was unable to pay the car loan payments, the bank finally took the car back. Jackson’s car was collateral which means something of value. Collateral guaratnees that you will pay back the loan to the bank. If you don’t pay back the money to the bank (which owns the car) they can take it back. Jackson played the fool in the situation because he wasted money on a car that he couldn’t afford.

In the book, I also learned more about investing. While my friends were spending money on junk I was thinking of what I could invest in instead of spending my money that I know that I wouldn’t get back. The book gave a great example of investing your money. Marquis and his family invested in a car wash in order to make money. I read this book called “Danny Dollar” that talks about inestment and saving money. I learned that Mark Cuban invested in a basketball team and was able to make a huge profit. I really love basketball and someday I might also invest in a team. My uncle taught me how to play Monopoly which is basically the game of investing. In the game you own property and invest all your money in them. But at the end as players land on your property, you collect money for your investment. Like he always says, “Don’t just hold on to your money. You have to spend money to make money”. When you own a house and invest all you money into it, and you think you’re broke, you are actually not. As people go around the board and land on your property you collect money from your investment.

Lastly I learned about the four P’s of running a business. They are very important because without them your business will not be successful. The first P is product. Product is very important because it has to be something valuable that people will actually use. The second P is price. Price is one of the most important things of running a business. Price is what gets people to buy the prouct. If the price is 20 dollars for a pencil no one will buy it because the price is not reasonable. Also promotion is another big thing when running a business. Promotion allows people to figure out your amazing product and amazing price. What is the point of having a great product what you have invested so much in but no one is buying it? Lastly, is place. Place is everything. Without place, there is no business. The place of your company has to be where most people can get to. For example, if you notice some people in the street selling waters on a hot day in Times Square. That’s because they know their place, lots of people are sweaty and thirsty and would like some water. So that’s why the four P’s are very important in business.

I learned a lot from the book “I Got Bank” and hope that I get the chance to invest in the bank OneUnited and put my savings account into it. I hope that I can win and try to catch up to Jazz with his two thousand dollars.

CAMARRIA SAUNDERS, 11, FLORIDA

Camarria’s Essay

I decided to read “The Kids Money Book” by Jamie McGillian. While reading the book I learned about teen spending and how to save money. I was able to learn good tips while reading this book. In this book, I discovered that most teens spend their money on food such as Starbucks, Chipotle, Chick-fil-a, and Panera Bread. Teens also like shopping at stores like Nike, Forever 21, American Eagle and Ralph Lauren. I am not a teenager yet but I also like to shop and eat at the same places with my mommy.

Recently, my parents gave me and my brother a $100 in cash. My mommy says we spend a lot of money on stuff we don’t need. At first, I didn’t understand what she meant until, I started spending all my money. My $100 was gone really fast. My mommy asked me what I spend my money on and it was mostly food and toys. I was able to understand that I waste a lot of my parent’s money.

There are different ways to save money and budgeting is one of them. My parents have a budget and sometimes I help my mother organize the family budget. Me and my brother have a “saving’s jar” that our parents made for us. The first day of every year, we start saving coins and in July my parents take us to cash it in at the bank. We take the money on our family vacation and are allowed to spend it however we want too. We start saving coins when we return from vacation and then in December we use the money to buy gifts for our family. This is one way I save money. Sometimes, my parents allow me to do chores to earn money and sometimes I save some of the money to use later.

Overall I plan to stop shopping a lot to help save money. I also plan to not eat out as much on the weekends. I will encourage my family to cook at home to save money. Also, I would like to continue reading books about money to learn how to budget my money and maybe give tips to my family and friends.

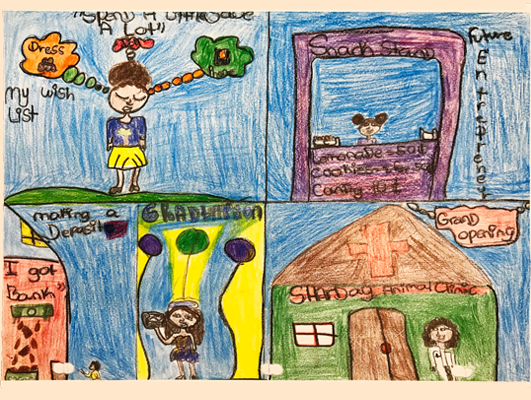

SHARDAY SYPHER, 10, FLORIDA

Sharday’s┬áArt

CORDAY YOAKUM, 8, CALIFORNIA

Corday’s Essay

Hi, my name is Corday and I am eight years old. I will be giving a lot imperative information about what I have learned from reading the awesome book. I have started saving money from doing chores around my house since I started reading the book.

I learned that Jazz granddad told him to save his money. He listened to his granddad and he did save his money that’s why he has over two-thousand dollars in his bank account. If his sister, brother, and his mom wants some money they should start saving their money to. He learned that by saving money you can generate a lot of money.

I read many different chapters in the book that taught me several ways to save money, so I can very successful in the future just like Jazz. I started washing my parent’s cars on Saturday mornings. I charge then five dollars for each car. Next week I am going to ask my neighbors next door if I could start washing their cars also. By washing more cars I can generate more money for my savings.

My mom started paying for doing chores around the house such as, folding clothes, and taking out the trash. Every Monday, Wednesday, and Saturday I fold my mom and my sister’s clothes then I put the clothes in the drawer. Then on Monday night I take the trash out. When I get home from school on Tuesday afternoon I bring the trash cans back in the backyard.

Starting on Saturday 3rd I will go to my Grandpa’s house and I will help do gardening work. At his house we pull weeds on the side of the house. Then I will help him cut the grass and water the plants.

I am very grateful I had the opportunity to read “I Got Bank” I learned how to save money. At the end of the week I will have a total of $76.00 saved up. My mom is taking me to OneUnited Bank so I can open my own savings account.