Summary

Say goodbye to bank lines and limited hours. The future of personal finance is right in your pocket—putting the power of financial management at your fingertips.

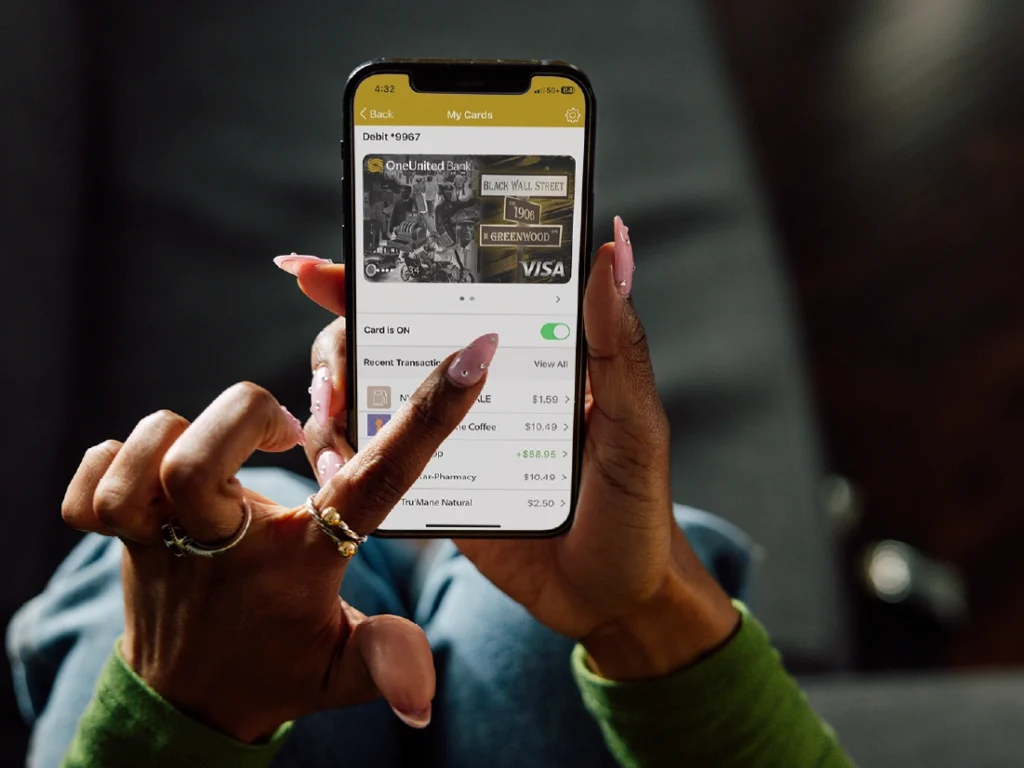

As the nation’s largest Black-owned bank, OneUnited is leading the digital banking revolution, making financial services more accessible, secure, and responsive for our community.

From enhanced security to real-time financial insights, we’re redefining what it means to bank smarter in the digital age.

Enhanced Security

Digital banking gives you something traditional branches can’t: next-level security.

From your living room to the grocery store, managing your money through the OneUnited Bank mobile app means:

- Real-time alerts to monitor transactions.

- The ability to freeze or unfreeze a lost or stolen card instantly.

- Fraud protection features to keep your funds safe and sound.

Peace of mind matters. Choosing to bank digitally means you’re in control 24/7—no waiting in line, no waiting on hold.

Convenience on Your Terms

Avoid putting your day on pause. Our digital banking tools make managing your money feel intuitive and quick.

- Mobile Check Deposit: Need to deposit a check? Once you have registered for our mobile deposit service, just snap a pic through our app. It’s that simple. No trip to the bank required.

- Card Command: We help you gain instant card control. Instantly access your digital card to shop online or in-store. Plus, no more anxiety about the security of a lost card. Freeze the card and even block transactions by location.

Whether you want to set up your card for a trip abroad or simply want to shop before your physical card arrives, Card Command puts you in charge.

Personalized Financial Management

Say hello to WiseOne™ Insights, your AI-driven financial wellness companion. AI WiseOne makes managing your money easier with personalized guidance.

Here’s how it works:

- Alerts you to bill payments that are higher than usual so you can take action before it affects your budget.

- Identifies extra funds you can save—think of it as your savings coach.

- Provides tailored debt payoff strategies to help you reduce debt faster and regain control of your finances.

Managing money is easier with a little encouragement and the right nudge. Designed to reduce financial stress and improve decision making, AI WiseOne™ acts as your financial wellness guide, helping you prioritize your financial health.

Go Digital Today!

With enhanced security, unmatched convenience, and tools like AI WiseOne™ Insights, we’ve redefined what it means to bank smart. Go digital and streamline your finances!

Join the movement and lean on tools that help make money management easy—giving you access and control anytime, anywhere.