When establishing or rebuilding credit, many are confused by the differences between secured and traditional credit cards. Even if you know the basic distinction between these cards, you likely have questions, like whether vendors will treat secured cards differently, whether these cards help or hurt your credit, and how the features and interest rates of secured cards compare to general credit cards.

What Makes a Credit Card Secured?

Traditional credit cards allow the borrower to draw on a line of credit that is secured only by that person’s credit score and signature. Secured credit cards, on the other hand, use a monetary deposit to acquire the card. If one fails to pay, the deposit (typically equal to the credit limit of the card) can be used to satisfy the outstanding obligation. This makes it possible for people with poor credit to have the benefits of a credit card even though they may not qualify for a more traditional account.

Secured credit cards can help establish or rebuild the customer’s credit history. They are not the same as a prepaid or debit card, though. Unlike prepaid cards, secured credit cards give the customer a credit line, and report payment activity to the major credit bureaus as though the card was a regular card. The security deposit merely works to ensure payment in the event of a default. Should you close the account the card issuer will return the deposit.

How Do Stores React to Secured Credit Cards?

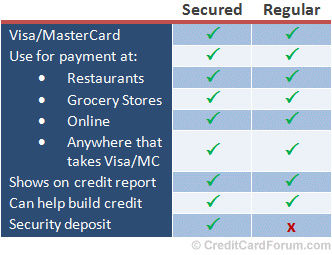

Secured cards are indistinguishable from regular credit cards. They are processed in exactly the same way as any other card, and the vendor incurs no special processing fees or other problems from accepting them as payment. These cards are accepted anywhere credit cards are. Also, they do not register as a debit card, so any vendor that may charge an additional fee or not accept a debit card will not do so with a secured card.

Benefits of Secured Credit Cards

Secured credit cards do have a few advantages over regular credit cards. They are great for people with less than optimal credit scores, as they represent a very low risk to the card issuer. The lower risk equates to lower interest rates for the consumer, but it also means people with bad credit can get a secured credit card. Having a secured credit card allows the consumer to begin building or rebuilding his or her credit score with a history of on-time payments and appropriate credit usage. Since the secured credit card issuer reports to all three major credit bureaus, using these cards is a great way to begin establishing credit without the risk of getting in over your head.

Is a Secured Card Right for You?

If you are a person who is suffering from a lack of credit or a negative credit score, then a secured card could be right for you. They offer most of the benefits of a traditional card. But, they are more available to those with poor credit (or no credit), have lower interest rates than unsecured credit cards for people with bad credit, and will keep you from ending up in expensive legal battles should you ever end up unable to pay the credit card bill.