Summary

There is a staggering decline in venture funding for Black businesses, beyond that of general declines overall. Despite facing systemic hurdles, a beacon of hope emerges for Black businesses. The Black Investor presents a beacon of hope, rallying support for sustainable investment in Black-owned ventures.

Funding continues to plunge for Black businesses. We must fight back so that solutions for the Black community thrive. The Black Investor is on the rise!

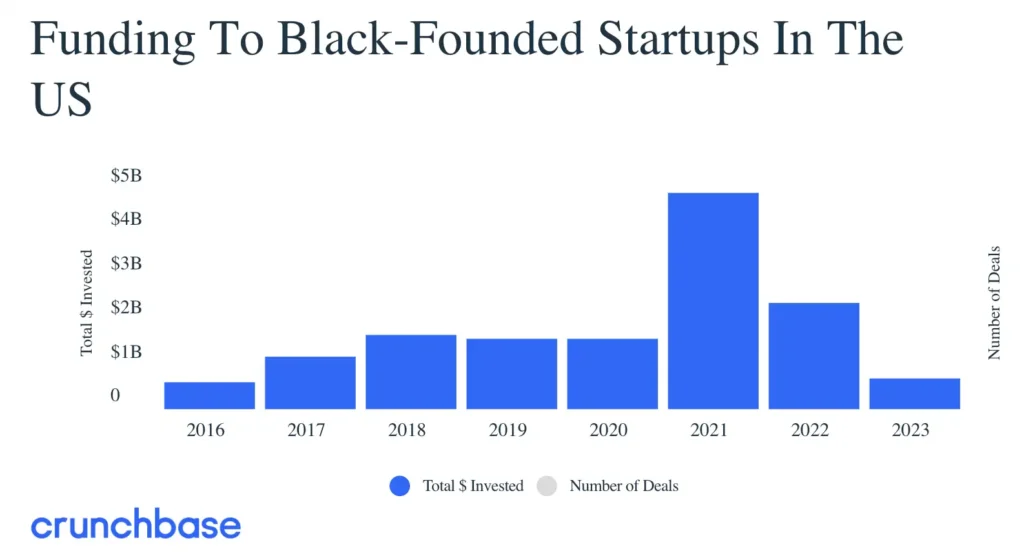

In 2023, venture funding for Black businesses plunged by 71% compared to 37% overall in the United States.

Since June 20, 2020, investors have made significant pledges to address diversity in investment. However, Black Americans share of total venture funding dropped from 1.4% in 2021 to 0.5% in 2023, pointing clearly to where flashy words and commitment make a strong departure.

Venture funds come from money pooled by investors in venture capital firms who invest in high-potential startups and small to medium-sized companies.

In a declining market, a decrease in investments—particularly in late-stage ventures—is expected. Unsurprisingly, the impact on Black businesses is notably severe. In 2021 and 2022, there were 17 rounds invested in Black-founded startups at $100 million or more, while in 2023, there was only 1.

”Late stage” refers to funding rounds of $100 million or more, which are much harder for the typical business to reach.

Renowned and well-funded startups typically continue to attract investment. Notable businesses like Calendly, Savage X Fenty, and Cityblock Health, however, last raised financing more than two years ago. Yes, Savage X Fenty… by Rihanna!

As society looks to bring the most innovative and valuable ideas to the market, investing in Black founders becomes increasingly critical.

We have an important message: Economic opportunity for Black Americans needs work! Investors predominantly look to invest in Black businesses as a trend. Investment in Black businesses must be sustainable and consistent to reap collective benefits.

In fact, Black people already make monumental leaps without equal opportunity. A survey conducted by Black Owners & Women’s (BOW) Collective revealed that 95% of their entrepreneurs leaned on personal finances to launch their companies, while only 13% had access to capital. Despite these funding headwinds, Black women continue to dominate as the fastest-growing entrepreneurial force in the USA. We know that’s right!

Within the venture capital industry, there is a small amount of representation at the table – 4% of total VCs according to the most recent edition of the VC Human Capital Survey. The decrease in funding to Black businesses simply reflects an imperative to diversify check writers.

People have gone to the streets to voice frustrations with ongoing systemic racism, made a commitment to support diversity investment funds, and customized programming aimed at empowering the Black community.

Black Americans can harness their emerging interest in investing, shown in their higher stock market participation, with 68% of Black respondents under 40 now investing, compared to 57% of younger white investors, to #InvestBlack!

We are all in this fight together. In 2022, OneUnited Bank launched its partnership with Lendistry, a Black-led fintech, to offer small business loans to our customers. The program offers loans from $50,000 to $5 million to companies that have been in business for two years or more. From several perspectives, we continue to champion change in funding and access to capital.

From our unique levels of influence, we put pressure on forces that keep Black-owned businesses from growing. Funds, skills, and time—let’s get them to our business owners and do what we can to close the funding gap.