As we enter the season of celebration and reflection, Kwanzaa emerges as a guiding light, emphasizing the significance of togetherness. Grab your candles and join us as we illuminate the history and significance of Kwanzaa in individual and community empowerment.

Created in 1966 by Dr. Maulana Karenga, Kwanzaa emerged during the civil rights movement as a response to the need for cultural affirmation and unity building. It serves as a tool for cultural reclamation, reconnecting us with our African roots.

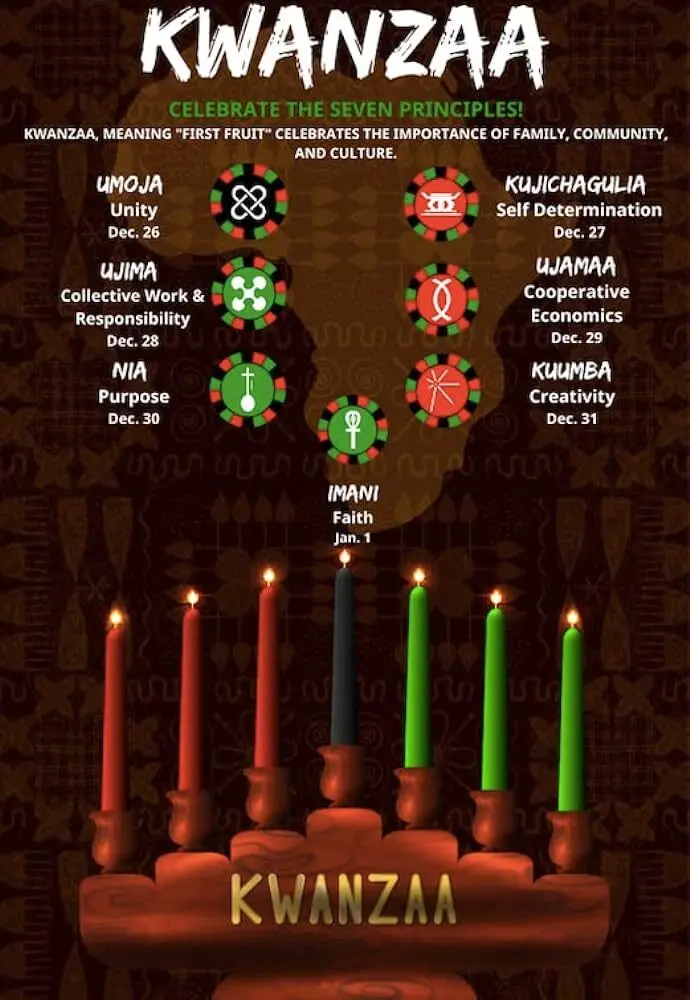

Kwanzaa’s 7 principles, known as Nguzo Saba, offer profound insights, particularly in the context of financial empowerment. Let’s explore each principle.

Umoja: Unity (December 26)

Umoja, the principle of unity, ignites the Kwanzaa celebration and emphasizes togetherness within our families and communities. It’s a commitment to the Ubuntu proverb, “I AM because WE ARE.” The candle of Umoja represents not just unity, but also humanity and solidarity.

Light the first candle: Showcase unity through intentional spending and financial support at your local businesses and within your community.

Community Spending: Understand the impact of intentional spending on local businesses and how it contributes to economic unity.

Kujichagulia: Self-Determination (December 27)

Kujichagulia, the call for self-determination, urges us to shape our destinies and celebrate our culture. It’s not just an individual pursuit but a collective effort to overcome and redefine our future.

Light the second candle: Reflect on personal achievements driven by self-determination and take your financial future into your own hands by elevating your financial knowledge with our Financial Education Center.

Individual Financial Literacy: Empower yourself with financial knowledge and contribute to your financial self-determination.

Ujima: Collective Work and Responsibility (December 28)

Ujima, the principle of collective work, reminds us of our responsibility to build and maintain our community.

Light the third candle: Engage in a collective project with loved ones, whether it’s a home improvement task or divvying up chores. Extend this spirit of collective responsibility to the community through volunteering.

Collective Financial Literacy: Collaborate with your friends and family to learn more about financial responsibility and challenge each other to keep up the habit.

Ujamaa: Cooperative Economics (December 29)

Ujamaa, emphasizing cooperative economics, forms the foundation of movements to circulate the Black dollar and bank with organizations that reflect our community priorities.

Light the fourth candle: Participate in movements championing economic empowerment and local business creation, recognizing the domino effect of supporting entrepreneurship and actions that promote community-wide prosperity.

Spending Impact: Understand the impact of spending choices on your community and how that aligns with cooperative economics.

Nia: Purpose (December 30)

Nia, the principle of purpose, challenges us to set goals that benefit not only ourselves but also our community.

Light the fifth candle: Actively participate in community initiatives and support local causes. Engage in conversations about community needs and explore how your skills and resources can contribute to positive change.

Root Your Goals In Purpose: Align your financial goals with a sense of purpose to enhance personal and community well-being in an equal capacity.

Kuumba: Creativity (December 31)

Kuumba celebrates creativity in all its forms, from art to problem-solving, underscoring the power of innovation. Many observe Karamu on the sixth day of Kwanzaa as a feast where the entire family comes together to enjoy each other’s company, share stories, and celebrate the year.

Light the sixth candle: Explore and leverage your creative skills to support your community and businesses.

Build Solutions: Create sustainable business solutions that can be a catalyst for community development like opening your own repair shop or tutoring service.

Imani: Faith (January 1)

Imani, the culmination of Kwanzaa, encourages us to have faith in ourselves, our community, and our ability to triumph over challenges.

Light the seventh candle: Cultivate a habit of financial mindfulness and stewardship. Believe that your actions contribute to building a more prosperous and economically empowered community.

Financial Literacy: Develop positive financial habits, like saving and investing, and build faith in your ability to build your financial future.

As we explore the principles of Kwanzaa, let’s not only celebrate but also integrate these ideals into our financial journey. In unity, determination, and collective prosperity, we find the strength to shape a brighter future for ourselves and our community.

Let’s embrace Kwanzaa’s principles and take action!