OneTransaction® to Build Generational Wealth: Your Credit Score

We, at OneUnited Bank, want you to focus on #OneTransaction to build generational wealth, which includes improving your credit score.

IMPORTANT NOTICE: OneUnited Bank is providing these links to websites as a customer service. OneUnited Bank is not responsible for the content available at these third party sites. The Bank's privacy policy does not apply to linked websites. Please consult the privacy disclosures on each third party website for further information.

Spend 5 min, Start Building Wealth

Accounts

For Businesses

Your Financial Future, Your Choice

Financial Wellness & Freedom

We, at OneUnited Bank, want you to focus on #OneTransaction to build generational wealth, which includes improving your credit score.

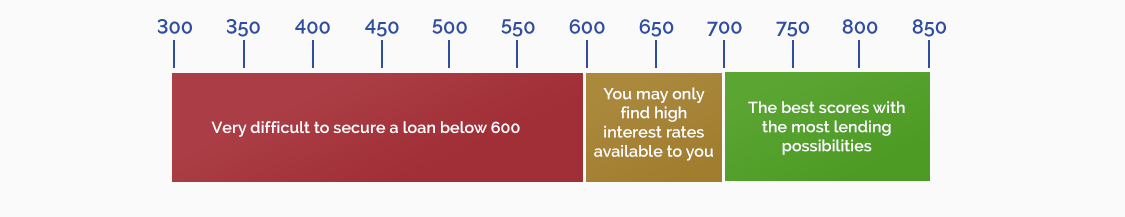

Today, companies use credit scores to make decisions on credit cards, auto loans, mortgages, insurance, and even employment. The higher your credit score, the more likely you are to get approved, pay less for your loan – or get hired. Credit scores range from 300-850.

Information about you and your credit experiences, like your bill-paying history, the number and type of accounts you have, whether you pay your bills by the due date, collection actions, outstanding debt, and the age of your accounts, is used to develop your credit score. Your credit score does not include such factors as your gender, race, religion, age, education level or marital status.

The Program

Order a FREE annual copy of your credit report from only one of the three major credit bureaus (TransUnion, Equifax, or Experian) at www.annualcreditreport.com. Order from only one credit bureau today, order from another credit bureau in four months and from the third credit bureau in eight months. That way you’ll receive ongoing information about your credit for FREE, every four months. Your credit report is a key to your credit score, so make sure it’s accurate and up to date. Make sure creditors are reporting correctly and you have not experienced identity theft.

If you do not have any credit or have bad credit, get a secured credit card like UNITY® Visa to begin to build or rebuild your credit. A secured Visa credit card is like any other Visa credit card. There is no difference in how it is treated. It’s simply a credit card that requires a cash security deposit, which sets your credit limit. (Note: The annual fee will reduce your available credit when you initially receive your UNITY Visa card and whenever the annual fee is charged.) Unlike prepaid cards, it reports to the credit bureaus and therefore can help you rebuild credit. Check with your bank or credit union to see if they offer a secured credit card and can show you how to rebuild credit.

Payment history is the #1 factor that influences your credit score. If you pay even one bill very late (60 days or more), your credit score can drop significantly. So to build credit, pay on time. Even if you only pay the minimum amount due.

The ratio of your balance to credit limit is an important factor that influences your credit score. So, don’t max out of your credit limit, even on your secured credit card. Keep your balance low or pay down your balance to rebuild credit. You can also increase your credit limit on your secured credit card (by contacting your bank or credit union and making an additional deposit) to increase your balance to credit limit ratio.

With some banks, your principal balance will not decrease if you only make the minimum payment. By making more than the minimum payment, you will improve the ratio of your balance to credit limit and rebuild credit.

Applying for multiple accounts within a short period of time can decrease your credit score. Research your credit options by reviewing the Schumer Box (an easy to read summary of credit card disclosures), which provides information on the annual percentage rate (APR) and fees to find the best secured credit card available, then apply for one secured credit card. Fixed rate cards are better than adjustable rate cards because your interest rate will not rise simply when market rates increase. Avoid cards with high penalty fees or rates.

A great way to improve your credit score is to pay down your current debt. Start by paying off low balance loans and then move to reduce the balances of larger loans. Do not over-extend yourself to pay down debt. Remember that making regular payments can improve your credit score…and making late payments can decrease your score. If you have additional funds after making your monthly payments, then pay down debt.

There are many online resources available to show you how to rebuild credit. Here are some suggestions:

Questionable negative items and inaccuracies on your credit report can and should be addressed. Be sure you work with a trusted professional that will work diligently and ethically to help you repair your credit reports, like Lexington Law®. Lexington Law is a consumer advocacy law firm with decades of experience helping hundreds of thousands of Americans work to improve their credit. Call 1-888-516-9077 or visit Lexington Law’s website to learn how they may be able to help you repair your credit.

This summary is to get you started. Please check with a financial advisor, an attorney, family members, and/or friends. Simply focus on getting this OneTransaction done to build generational wealth!

OneUnited Bank is not a financial advisor and recommends you discuss with your family and a financial advisor. All services, including non-real estate secured business loans or equity capital, are not offered by OneUnited Bank. To learn more visit our Loans page.

See exactly where you’re spending money, how you’re achieving and how you can improve.

Accounts

Essentials

Elevate Finances

For Businesses