Kings and Queens teach their children how to manage their treasure!

With the 9th Annual I Got Bank Financial Literacy Contest, ten children will win a $1,000 savings account. To participate, simply visit www.oneunited.com/book.

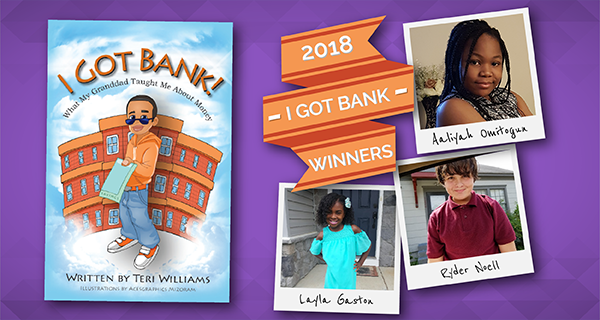

Here are three of our 2018 winners (in alphabetical order) and their essays: Layla Gaston, 8, Havre de Grace, MD, Ryder Noell, 11, Stuttgart, AR, Aaliyah Omitogun, 12, Suitland MD.

Meet Layla…only 8 years old and she won a $1,000 savings account! Children age 8 to 12 can participate! Congratulations Layla!!!

LAYLA GASTON, 8, HAVRE DE GRACE, MD

I learned a lot about how to make and save money by reading a book called “A Smart Girl’s Guide: Money” by Nancy Holyoke. There were a lot of good tips in this book about how to be responsible with money. I am going to use the things I learned in this book to save money for myself and my family.

The first thing I learned was how to start a business. You can earn money by doing extra chores or jobs for people in your neighborhood. Before starting a business, some things you need to brainstorm about are skills and training, tools and supplies, money, permission from your parents, time, safety, and the price. I will think about all these things to come up with a good plan to start my own business.

The second thing I learned from this book is that saving money is very important. If there is something you really want to buy but you do not have enough money for it, you will have to save up for it. A good way to save money is to put it in the bank. This way, it is harder to just use it because you will need your mom and dad to take it out. Another way to save is to keep your spending and saving money separate from one another. This is good advice.

The third thing I learned was about different types of banking. One thing you can do is get a credit card from the bank. A credit card is like borrowing money that you will have to pay back later a little bit at a time. You could also use a debit card. A debit card is like a wallet holding all the money you put in the bank. Another way of using banking is by investing. Investing your money will make it grow like rolling a snowball down a hill to get bigger and bigger. If you start investing and saving money when you are young you can become a billionaire.

Now that I know how to take care of money responsibly, I will make sure to put some of my money in a separate savings jar and spending jar. I will also ask my mom and dad to put some of my money in a bank account. I will save my money for things I really want and also save just to be prepared for anything else. Another thing I’ll do is to give to others who have less than me and my family. I pass out gifts to other kids at Christmas time and that makes me feel good. I will always make sure to focus on the money I do have and not focus on the money I do not have. I will be sure to save first, make a budget, know the difference between wants and needs, and grow good money habits. Lastly I will teach my two little sisters about saving money also.

There was a great article in the Stuttgart Daily Leader when Ryder won! We even sent a big $1,000 check. We love celebrating our winners! Congratulations Ryder!!!

RYDER NOELL, 11, STUTTGART, AR

Me and Jazz Ellington have a lot in common. Well first thing is that I don’t like waking up early on Saturdays either. Second is that he has a big family like I do. After reading the book, “I Got Bank,” I learned quite a bit. I learned that Jazz is a really smart ten year old, his granddad really helped him by teaching him how to save and I want bank too.

I have always known that I like money and that money is a thing that we have to have if we want something, but Jazz has a very good point. How do you save money if everyone around you is broke and needs something? I think I will do like he does and just hide my bank statements. If no one knows you have any money then maybe they won’t think to ask you.

I like how Jazz’s grandpa shares a lot of very good tips for saving and why you need to. One reason you should save is because it’s not how much money you make on payday, but how much you keep in your bank account that will make a difference. Jazz learns this at a very young age. Something which I am glad I am learning at the same age. He was very lucky to have his granddad share this information, but it was very smart of him to use it. I mean he is 10 years old with $2050.23 in his bank account.

My mother has myself and three other children. She has been through a divorce and hasn’t always had a lot of money to just give to me and my brothers and sisters. I mean she does get us toys, games and takes us swimming when she can, but she has not always been able to do so. After reading this book, I have learned that I do not have to depend on my mother to be able to have money. I can start doing things here and there to earn money and then see if my mom will open up a bank account for me too.

Aaliyah certainly knows how to manage her treasure, including her $1,000 winnings! Yes, a future Queen! Congratulations Aaliyah!!!

AALIYAH OMITOGUN, 12, SUITLAND MD

Up until I read this book “I Got Bank” I never considered having a bank account, I always thought I was too young, neither did my parents advise me on having one. The purpose of this essay is to highlight what I learnt in this book and how I can apply these lessons in my life.

Firstly, according to Jazz’s grandpa, “you can never beat the power of saving a little each week”. I realized how easy it is to save up for college. If I’m able to save all the money I’ve been gifted so far and talk to my parents about the GAP (Grandpa’s Allowance Plan) then I can have eleven dollars a week for a few weeks until my next birthday. In the next six years when it’s time for college I would have saved close to four thousand dollars. Whoa! That’s a lot of money and that will make things a lot easier for me and my parents when the time comes.

Also, I learnt a lot of bank terminologies and their meaning like CD (a Certificate of Deposit), credit score, bounced checks, collateral, ChexSystems, checking account and other types of accounts, and so on.

Lastly, I learnt a very important lesson that I will never forget in my entire life, and that is to never ever spend more than you have. It always leads to financial troubles and it takes a very long time to get out of. Sometimes people never recover from such troubles. So, to be financially stable in life, I have learnt to save up and never spend money that I do not have.

Minor edits made in the essays. For details, please visit www.oneunited.com/book. Also to learn about the Children’s Online Privacy Protection Act, please visit our Privacy page.