Summary

AI-powered banking is providing personalized financial guidance to help customers achieve their financial goals and build generational wealth.

Artificial Intelligence, or AI, seems to be everywhere – but many people have no idea how to practically use it to improve their finances.

A new era in banking has put customers in the driver’s seat and is helping them reach financial independence faster. From our innovative financial wellness companion WiseOne™ Insights to versatile mobile apps, recent advancements have made managing your finances more convenient than ever, enhancing accessibility and guiding our community towards making better financial decisions.

The Role of AI in Modern Banking

AI is redefining our relationship with banking by making sophisticated financial tools accessible to more people. Traditionally, personalized financial advice was often reserved for those who could afford it. Today, AI-driven solutions are leveling the playing field and offering real-time, personalized guidance that helps you manage your money more effectively. Whether it’s through automated savings plans, customized budgeting advice, or debt management strategies, AI enables customers to take control of their financial well-being with ease.

Per a 2024 Pew Research Center report, a majority of Black American adults experience at least one of eight financial worries on a daily, or near daily, basis. By breaking down barriers to financial services, AI is not only improving access but also offsetting financial stress. With instant, tailored insights, customers can make informed decisions when building savings, reducing debt, and avoiding unnecessary fees.

Personalized Banking with WiseOne™ Insights

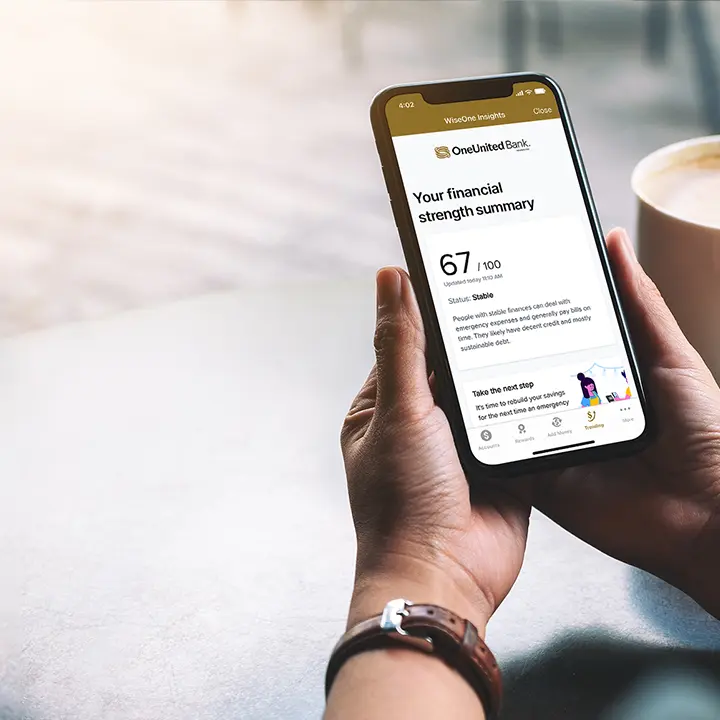

A prime example of AI’s potential in banking is WiseOne™ Insights, our innovative financial wellness companion. As the first AI-driven solution from a Black-owned bank, WiseOne™ Insights is designed to elevate our customer’s finances and help them build generational wealth.

WiseOne™ Insights offers three key types of actionable guidance:

- Insights that Guide: The ‘Save Enough to Live On’ plan helps you develop a personalized savings strategy based on your unique financial situation.

- Insights that Inform: The ‘Debt Payoff Strategy’ plan provides a customized approach to managing and eliminating debt, helping you achieve financial independence faster.

- Insights that Protect: Alerts like ‘New Fee Detected’ keep you informed about unexpected charges, allowing you to take immediate action to protect your finances.

A Future Driven by Technology and AI

Whether you’re looking to save more, pay off debt, or simply stay on top of your finances, artificial intelligence is making it easier to manage your money wisely and achieve financial independence.

As AI continues to evolve, its impact on banking will only continue to grow. We are proud to lead the charge of ensuring that technology serves not just as a convenience, but also as a tool for empowering our customers financially. The future of banking must work for more of us.

For current OneUnited Bank customers, you can find WiseOne™ Insights in online/mobile banking. Simply watch our video “How to Elevate Your Finances with WiseOne™ Insights”. #BankWhereYouWantToBe