OneUnited Bank | Esusu

Boost Your Credit with Rent Reporting

Powered by Esusu

Is your credit score holding you back? OneUnited Bank has teamed up with Esusu to get you the credit you deserve for paying rent on time.

IMPORTANT NOTICE: OneUnited Bank is providing these links to websites as a customer service. OneUnited Bank is not responsible for the content available at these third party sites. The Bank's privacy policy does not apply to linked websites. Please consult the privacy disclosures on each third party website for further information.

Spend 5 min, Start Building Wealth

Accounts

For Businesses

Your Financial Future, Your Choice

Financial Wellness & Freedom

OneUnited Bank | Esusu

Is your credit score holding you back? OneUnited Bank has teamed up with Esusu to get you the credit you deserve for paying rent on time.

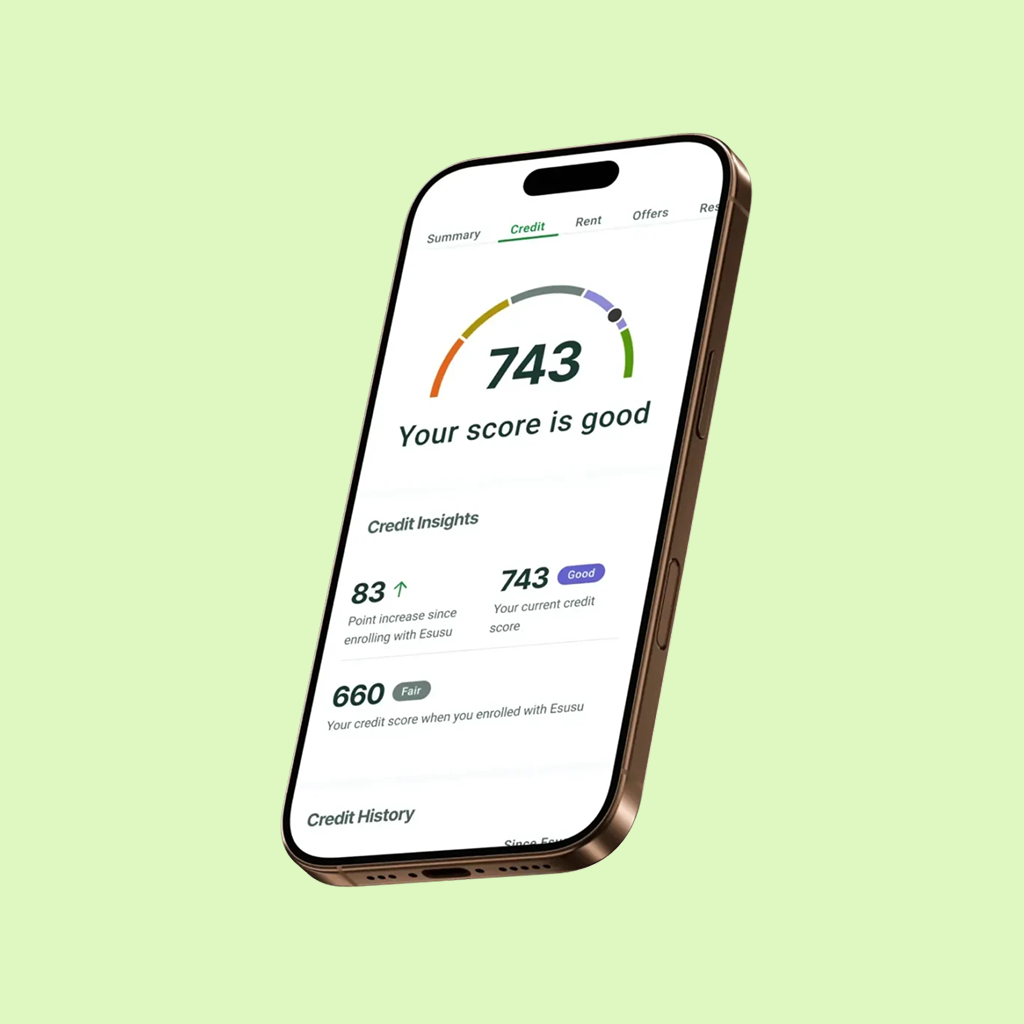

Boost your score by reporting your on-time monthly payments and monitor your credit score progress for only $2.50/month*.

Reporting to all three bureaus: Experian, Equifax, and TransUnion.

Securely link your bank account to report rent payments with no hard credit pull.

24 month rental history for your current lease included.

Esusu leverages data to help people overcome the biggest barrier to financial stability and freedom: their credit score. In the U.S. a credit score is the lifeline to the financial system. To date, 45M+ Americans lack credit scores, and millions more are locked out of the financial system due to their background, race, and zip code. Esusu reports rent payments to the three major credit bureaus, resulting in an average credit score increase of +45 points for Esusu renters. Esusu renters have now accessed nearly $50 billion in new credit tradelines for things like mortgages, auto loans, credit cards and student loans and roughly 200,000 renters established first-time credit scores through Esusu.

Accounts

Essentials

Elevate Finances

For Businesses