We offer business bank accounts to businesses in our market areas of Boston, Los Angeles and Miami. New business banking customers must open their first account in person in one of our branches but can manage their account online once the account is opened.

Here are the requirements to open a business bank account with us.

- Employer Identification Number (EIN) or Social Security Number (SSN). OneUnited Bank requires business customers provide their employer identification number (EIN) in order to open a business checking or savings account for most businesses. Sole proprietors can open a business account with their Social Security Number. Non-Profits are required to provide evidence of their non-profit tax status.

- Personal identification. Just as when you open a personal bank account, each authorized signer will need to provide a driver’s license or another form of state-issued identification to prove you are who you say you are.

- Business formation documents. OneUnited Bank will need a copy of your formation documents. For limited liability companies (LLCs), this means the articles of organization; for a corporation, it’s the articles of incorporation. These documents list some basic information about your company, including its management structure, who is responsible for managing the finances, and how your business will operate.

- Ownership agreements. If you’re running a partnership or an LLC you and the other owners will need to create a partnership or operating agreement. This will outline each owner’s rights and responsibilities as well as how the business will operate.

- Business license. OneUnited Bank needs proof that your business has the appropriate licenses before you can open a business bank account. The requirements to obtain a business license vary depending on where you live, your business, or professional status so do some research to find out what’s required in your area.

- Certificate of assumed/fictitious name. If the name you use to conduct or advertise your business to your customers is different from the company’s legal entity name, you will need a certificate of assumed name, also known as a doing-business-as (DBA)/fictitious name statement. OneUnited Bank will need a copy of this when you open your business bank account and proof of publication if your business is less than 6 months old.

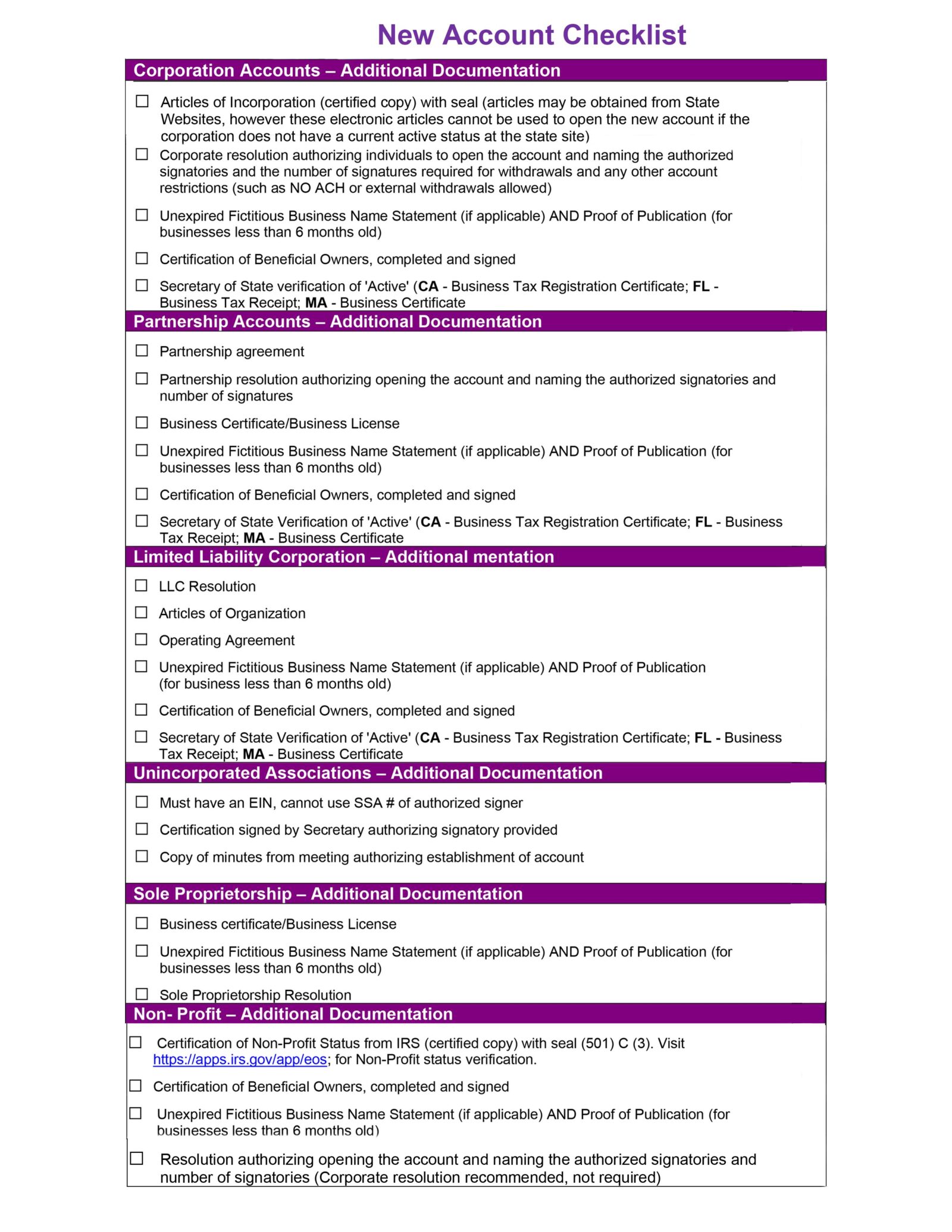

1 There may be additional documentation requirements.

Below is a chart of information that will be required:

If you have any questions, please contact us at www.oneunited.com/contactus or call us at 877-663-8648.